Improve Your Credit Now!

Boost Your Credit Strength | Eliminate Negative Entries | Guaranteed Refund

How It Works

Identifying Credit Issues

As the initial step toward improving your credit, we focus on pinpointing inaccurate data that's dragging down your score. This involves a thorough credit analysis process. Once we identify the issues, we equip you with the necessary information to take action, initiating the removal of inaccurate remarks and bolstering your credit score. Throughout this journey, we provide guidance at every stage, aiming solely to aid consumers in rebuilding their credit ratings.

Challenging Inaccuracies

After identifying non-verifiable, inaccurate, or misleading information, we enter it into our system to commence the challenging process. This involves disputing information reported by credit bureaus, creditors, and collectors, with dispute letters sent to each party. This phase typically takes 30 to 40 days as we await responses and updates, ensuring a comprehensive approach to restoring your credit.

Analyzing Updated Reports

Upon receiving updated reports from suppliers, we review them to confirm the removal or updating of inaccurate, unverifiable, or misleading information. If any data persists, we engage with the reporting entities to understand why the changes weren't made. Once resolved, we move on to addressing the next disputable item, ensuring a thorough credit restoration process.

Ongoing Education

Throughout the credit restoration journey, we provide continuous education and information to help you elevate your credit score. This includes insights into rebuilding credit and access to products like credit monitoring and credit builder accounts, supporting your efforts to achieve and maintain a healthy credit profile.

Why Choose Us

Our Services

Repair

Begin the journey to reclaiming your financial stability by eliminating inaccurate entries from your credit report. Consumers have the legal right to dispute such inaccuracies if they believe the information is incorrect.

Rebuild

While we work on rectifying inaccurate data, it's crucial to rebuild your credit history. Merely removing negative items isn't sufficient; demonstrating consistent, timely payments is essential to proving creditworthiness to FICO and creditors.

Raise Your Score

The third step to restoring your credit is to focus on raising your credit score. As we all know, the credit score is the number one factor when it comes to getting approved for a loan. If you have a low credit score, you can get denied or pay high interest rates.

Need help?

Are you struggling with inaccuracies dragging down your credit score? Our credit repair services are designed to help you navigate the complexities of disputing inaccurate information on your credit report. From identifying and challenging erroneous entries to rebuilding your credit history and elevating your score, we provide step-by-step guidance and support throughout the process. Take the first step towards financial recovery with our expert assistance.

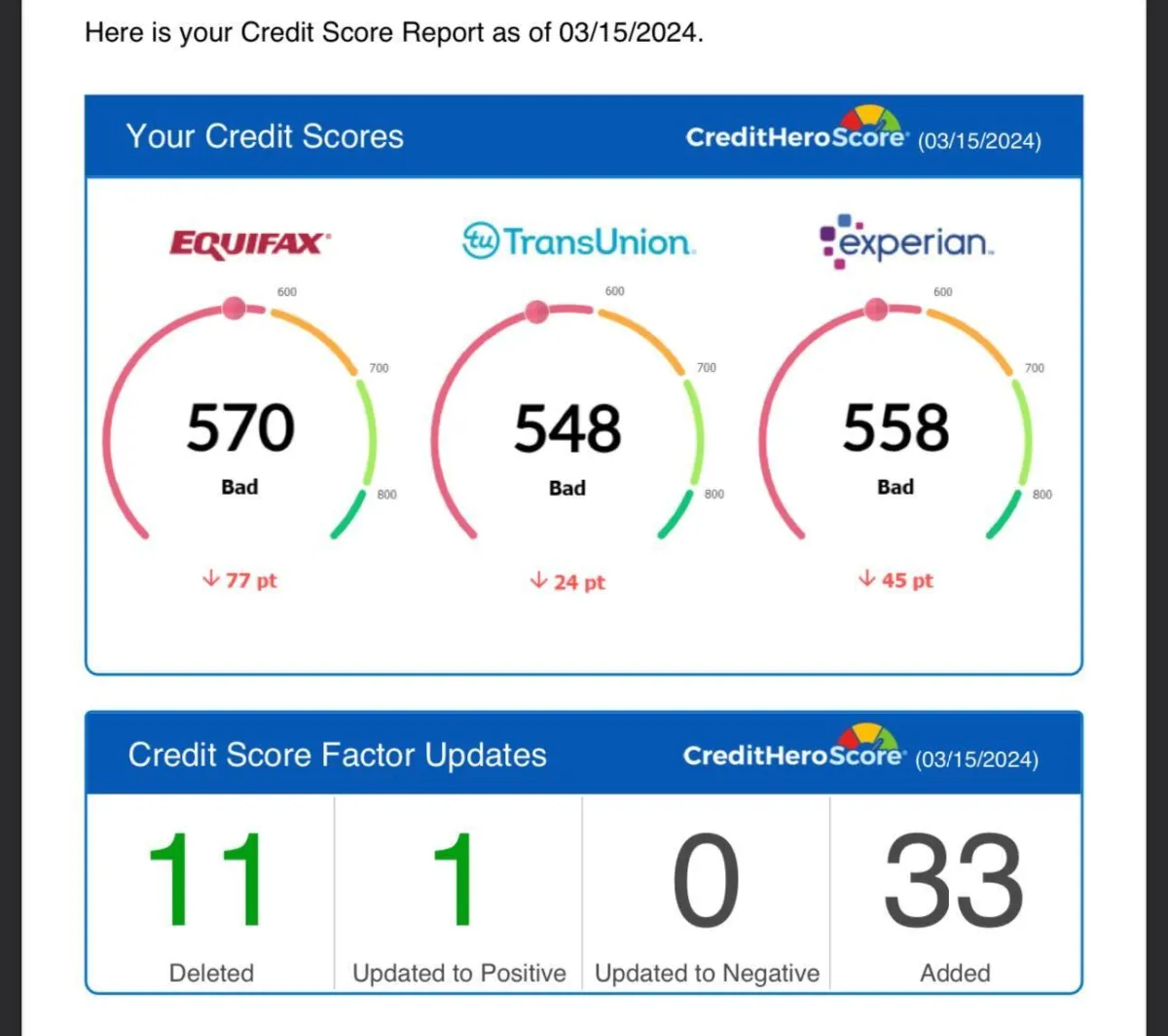

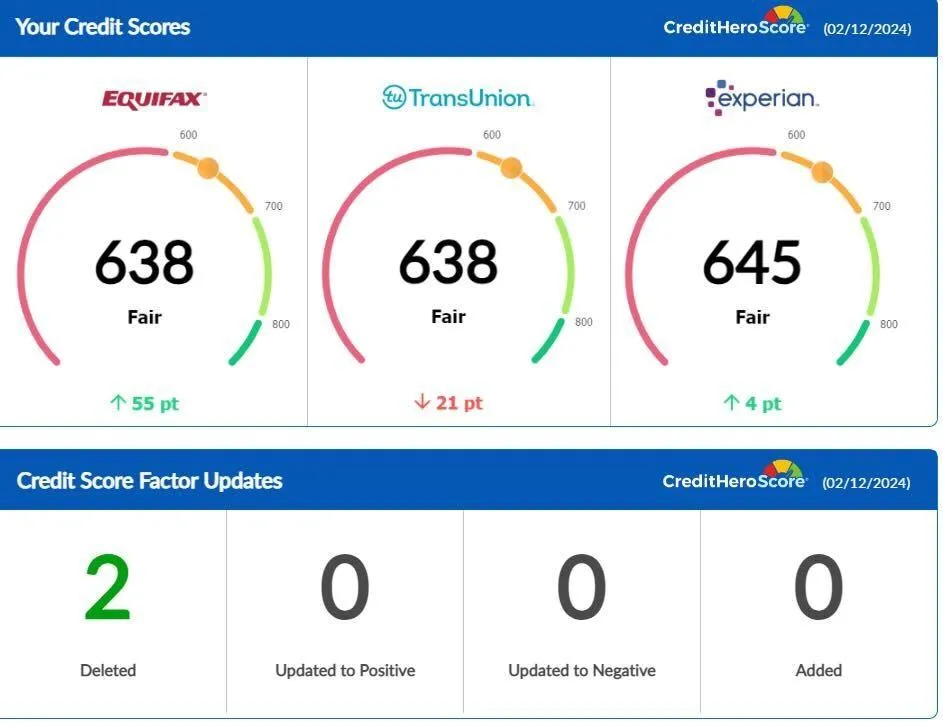

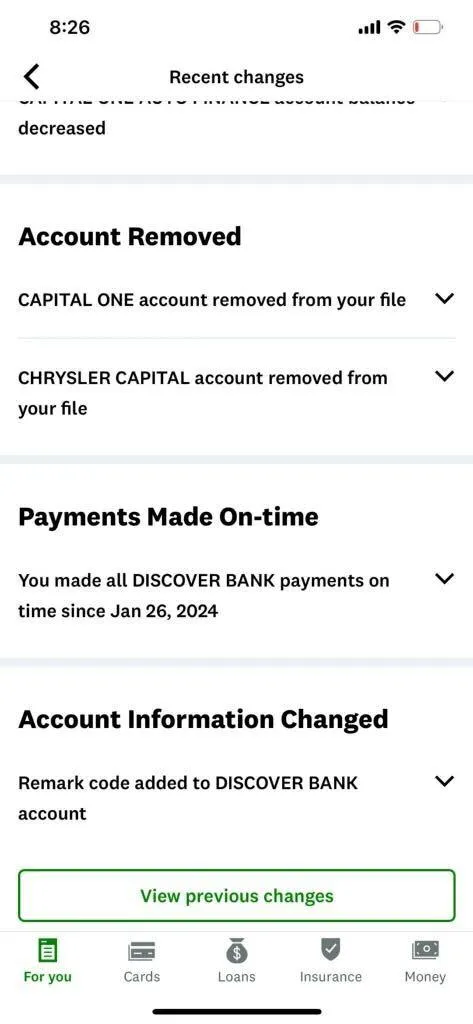

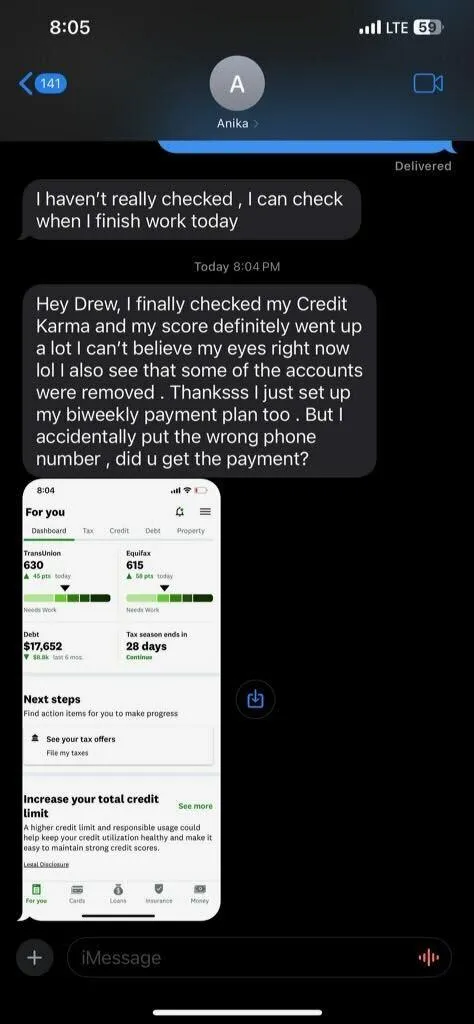

Results

Get In Touch

Assistance Hours

Mon – Sat 9:00am – 8:00pm

Sunday – CLOSED

Copyright 2022 . All rights reserved

@drewfixedit